Given recent headlines around business failures and the messages coming out of the funding market of a move onto a recession footing, discussions have turned to solutions to manage risks.

In today’s competitive business landscape, managing credit risk is crucial for the financial health and stability of companies. One effective strategy to mitigate credit risk is by securing bad debt insurance. This article explores the concept of credit risk, the importance of bad debt insurance, and the processing businesses can undertake to safeguard their financial interests.

Understanding Credit Risk

Credit risk refers to the potential loss a business may incur due to non-payment or delayed payment by its customers. It arises from extending credit to customers who may default on their payment obligations. For businesses, managing credit risk is vital to maintain cash flow, minimize financial losses, and ensure sustained operations.

The Importance of Bad Debt Insurance

Bad debt insurance, also known as trade credit insurance or accounts receivable insurance, provides protection against non-payment by customers due to insolvency, bankruptcy, or other defined events. It acts as a safeguard, allowing businesses to recover outstanding debts and mitigate the negative impact of customer default. Here are key benefits of bad debt insurance:

- Enhanced Cash Flow: Bad debt insurance provides a safety net by reimbursing a percentage of the unpaid amount, thus improving cash flow and minimizing the impact on working capital.

- Risk Diversification: By transferring credit risk to an insurance provider, businesses can diversify their risk exposure and protect against potential losses from customer defaults.

- Confidence in Customer Relationships: Having bad debt insurance coverage enables businesses to offer more flexible credit terms to customers, fostering stronger relationships and increasing sales opportunities.

- Improved Financing Opportunities: Lenders often consider bad debt insurance as a positive factor when assessing the creditworthiness of a business. Having coverage can enhance the chances of securing favorable financing terms.

To effectively manage credit risk and leverage bad debt insurance, processing businesses should undertake the following steps:

- Customer Due Diligence: Conduct thorough credit assessments before extending credit to customers. Consider factors such as credit history, financial stability, payment track record, and industry reputation. This helps identify potential credit risks and determine appropriate credit limits.

- Credit Terms and Policies: Establish clear and well-defined credit terms and policies. Communicate them to customers and ensure they understand their obligations. Specify payment terms, credit limits, and consequences for late or non-payment.

- Regular Monitoring and Evaluation: Continuously monitor customer payment behavior and promptly address any red flags. Establish an effective accounts receivable management system to track payments, send reminders, and escalate collection efforts when necessary.

- Credit Insurance Evaluation: Assess different bad debt insurance options available in the market. Compare coverage terms, exclusions, and premium costs. Work with an experienced insurance broker who can guide you through the selection process and recommend appropriate coverage for your business.

- Claims Management: Familiarise yourself with the claims process of your bad debt insurance provider. Understand the documentation requirements, claim submission procedures, and timelines. Promptly submit claims for eligible unpaid invoices to maximise recovery

- Ongoing Review: Regularly review and update your credit risk management and bad debt insurance strategies. Reassess credit limits, terms, and insurance coverage as your business grows or market conditions change. Stay informed about the creditworthiness of your customers and adjust your risk mitigation efforts accordingly.

Managing credit risk is vital for the financial stability and growth of processing businesses. By implementing effective credit risk management practices and securing bad debt insurance coverage, businesses can protect their cash flow, enhance customer relationships, and minimize losses arising from customer defaults. Conducting thorough due diligence, establishing clear credit policies, and working with reputable insurance providers are key steps to safeguard your business against credit risks.

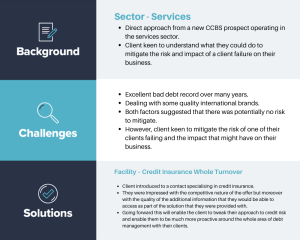

Recent credit insurance deals we’ve completed:

See latest deals.

If this sounds like something your business would benefit from, contact us today for a no-oligation chat at info@ccbsg.co.uk or use our contact form.